What is Confirmation of Payee?

Confirmation of Payee, also known as Verification of Payee, is an account name-checking service designed to prevent fraud.

Banking customers will encounter Confirmation of Payee during bank-to-bank transactions. The service asks the sender to confirm the name and account number of the person they are sending money to, and checks if the name supplied matches the name on the receiver’s account.

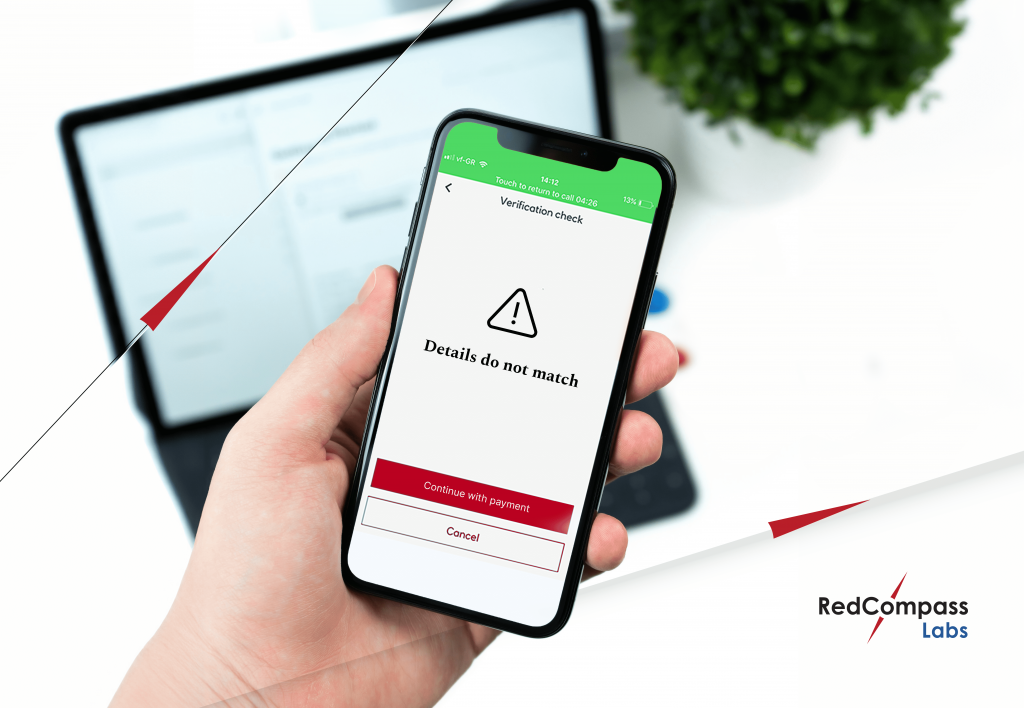

If the names do not match, the transaction will be held and the sender will receive a notification warning them of the discrepancy.

How does Confirmation of Payee work?

Confirmation of Payee is an especially important control measure in the world of Instant Payments. This is because Instant Payments transactions clear in as little as ten seconds, giving the sender no opportunity to cancel a transaction once it has been sent.

By manipulating the speed-to-transfer capabilities of Instant Payments, some scammers have adopted a method called authorised push-payment fraud to trick victims into sending large sums of money.

Customer enters payer details

A payee wants to send money. They enter the name and account number of the account they wish to pay.

Details must match

With Confirmation of Payee, the recipient’s details must precisely match the name on the account.

Payer bank contacts payee bank

With Confirmation of Payee, the recipient’s details must precisely match the name on the account.

Payment is sent if details are confirmed

If the receiver’s bank confirms the names match, the transaction is processed.

Launched in 2020

Confirmation of Payee in the UK

Since launching in 2020, the UK has become one of the leading countries in adopting Confirmation of Payee services to prevent fraud.

Confirmation of Payee is an API-based peer-to-peer service managed in the United Kingdom by Pay.UK. To join the scheme, you’ll need to apply, either directly or through an aggregator.

1.9 million

Daily transactions in the UK vetted by Confirmation of Payee

100+

Financial institutions in the UK to adopt Confirmation of Payee

400+

Financial institutions expected to adopt Confirmation of Payee in 2024

Protect your customers

How could you benefit?

As the world moves towards Instant Payments, checks and measures such as Confirmation of Payee will become more important than ever, potentially stopping billions of fraudulent transactions.

As a payment services provider, it is vital to consider the wellbeing of your customers and clients. Confirmation of Payee is one of the ways to ensure your services are compliant, secure and offered with your customers’ wellbeing in mind.

Implementing Confirmation of Payee may incur short-term costs for your organisation, but these costs will pay themselves off in reduced exposure to liability, and time and cost savings that would otherwise be spent following up instances of fraud.

The time to act is now

Protecting your clients against fraud is non-negotiable

Confirmation of Payee is a powerful weapon in the fight against fraud. But as a payment services provider, it’s up to you to implement Confirmation of Payee checks yourself.

However, implementing Confirmation of Payee will be far from simple

When it comes to implementing Confirmation of Payee, it pays to work with a payments experts. This will not only save you time and money but also guarantee a more effective integration, helping you meet regulatory standards.

Choosing a service

You will need to choose an existing Confirmation of Payee supplier, or be willing to build the function in-house. Some countries, such as the UK, Netherlands, France and Italy already have mature solutions, but the choices may be limited elsewhere.

Integration

You will need to integrate Confirmation of Payee into your existing payments infrastructure and processes. This includes building Confirmation of Payee into the user interface for your transactions.

Go live

The system will need to be thoroughly tested to ensure it is able to communicate with other banks in real-time, and with 100% accuracy. After going live, you will need to have resources set aside to manage the system, ensuring it remains secure and compliant.

Communication

With the system successfully implemented, it’s up to you to educate and inform your users. They must understand what Confirmation of Payee is, what their responsibilities are, and any breaches they must look out for.

Global payments experts

Why choose RedCompass Labs?

We’ve helped some of the biggest banks on the planet embrace the future of payments.

22+

years in payments modernization

24

countries

200+

years of banking experience

300+

successful projects