The European Instant Payments Regulation has reached its first checkpoint: as of today, all banks in Europe must be equipped to receive SEPA (Single European Payments Area) Instant Payments. This marks the first step on the challenging journey toward full compliance.

But there’s little time to celebrate. The next major milestone loom just months away.

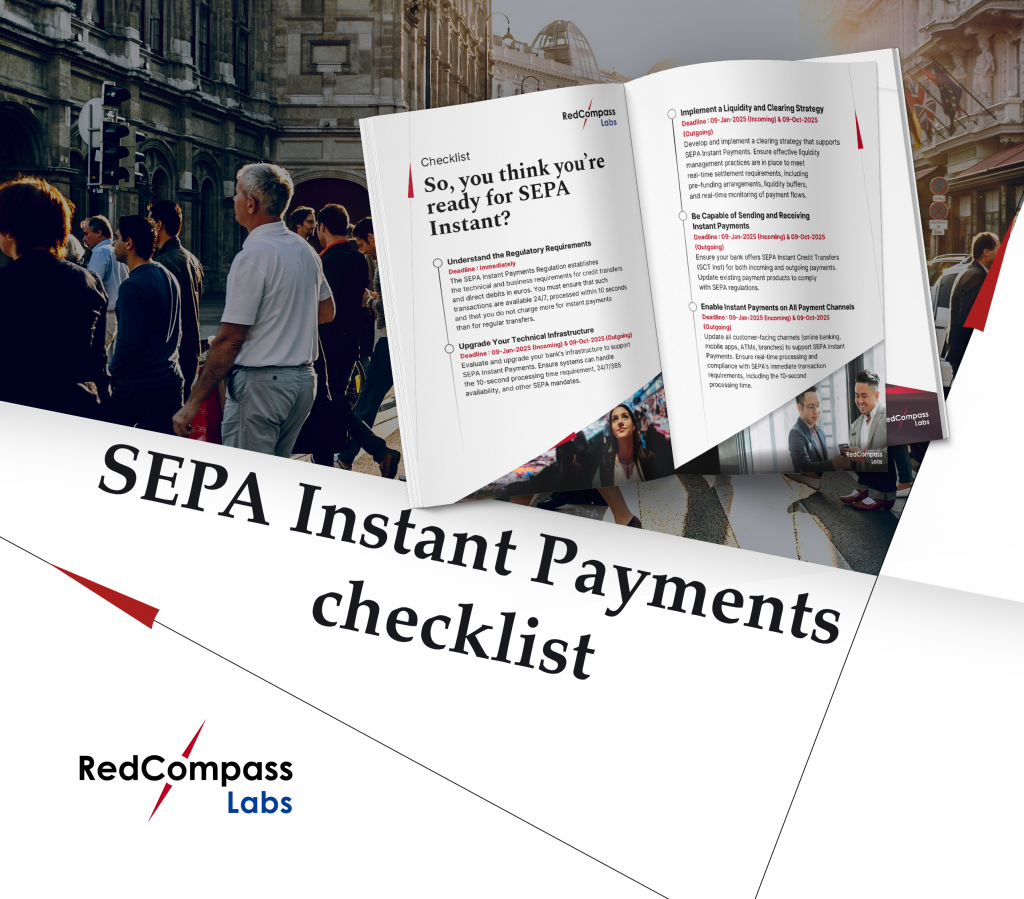

In this article, we’ll explore the key regulatory milestones European banks face in 2025, with a focus on Verification of Payee and SEPA Instant Payments. We’ll break down the critical deadlines, explain their significance, and outline what you need to prepare by when.

If you thought phase one was hard, wait till you see what’s next.

February: EPC Directory Service designs published

Come February, the European Payments Council (EPC) is expected to unveil the design of its Directory Service (EDS) – a centralized database containing up-to-date information on EU banks. It’s essentially the Yellow Pages for the Verification of Payee scheme.

Banks will refer to the EDS when reaching out to other banks to check the identity of a payee during a transaction.

However, implementing the EDS will not be easy. While it serves as a directory, the EDS does not handle the routing or verification of VoP requests and responses. Every bank in Europe will need to read the rulebook and implement it in the same, standardized way for the scheme to work. That’s a big challenge.

To solve it, banks may need to source a routing and verification mechanism (RVM), a technical service provider, to send and receive requests for information.

What’s more, the EDS will not be ready to test until June 2025. With specifications released in February, banks should begin preparing ahead of time.

What do banks need to do ahead of February?

If you haven’t already, seek advice. It doesn’t matter if you already have a domestic Verification of Payee solution. You will need to abide by the new standardized format outlined in the VoP rulebook and implement it by October 5th.

Understand the requirements of the EDS ahead of June so you can plug in to test your solution when it launches.

June: Testing the waters

Come summertime, the EPC Directory Service will be ready for testing. By then you must have a working Verification of Payee solution to connect to the EDS. This will give you three months for testing.

Verification of Payee will cover SEPA payments on all payment channels. That includes online and mobile channels, but also transactions over the telephone, in person, and on paper. Crucially, it will also cover bulk payment files.

Implementing your new fraud solution, then, is a question of customer experience. How can you offer the same slick journey – verifying customer details within five seconds – to a person making a payment over the telephone? What if your corporate customer submits 200 payments at once via a bulk file and they all come back with a “close match” or “no match” response? What’s the best way to let them know?

You should have an answer to some of these questions by now. Remember, VoP is a mandatory pan-European service for all SEPA payments. You must rethink existing solutions to make them fit for the October deadline.

(That said, corporates can opt out of VoP as per the regulations if they’d prefer.)

What do banks need to do ahead of June?

Make sure you have an RVM – if you need one. With every passing day, the window for testing your VoP solution gets tighter.

Plan your customer experience early. Digital channels need a slick, branded user journey. Consider everything: from repaying a friend to a company paying 200 employees. Focus on your telephone, branch-based, and paper channels, too. You need to establish best practices and then train your staff to deliver them. This will take time.

October: The final push

There are two peaks to climb in October. The first is the Verification of Payee deadline on the 5th. The second – the summit – is the SEPA instant payments deadline for sending instant payments on the 9th.

Part of this work will include navigating the removal of the 100K limit for SEPA Instant Payments. A corporate customer will now be able to make billion euro transfers on a Saturday night when all your branches are closed and all your staff tucked up in bed. That could introduce new challenges around liquidity and risk management. You’ll need enough cash on hand to finance these new payment peaks. How much is enough? Where will it come from? (And could that money have been put to good use elsewhere?) You must be prepared for larger, potentially riskier payments to be processed instantly at any time.

Then, you will need to decipher how to match these capabilities across borders. The UK, for example, is in scope for SEPA but it’s not currently under the Instant Payments Regulation. Thus, payments sent from UK-based accounts (which are not subject to the 10-second rule) to the EU (which is) could face delays. Banks are under pressure to offer the same level of service in Europe regardless of geography.

What do banks need to do ahead of October?

In a word: everything.

First, upgrade your systems to meet SEPA Instant’s requirements, including 10-second processing times and 24/7 availability. Instant payments must be available across all customer channels, like online banking, mobile apps, ATMs, and branches. Test your customer experience.

You also need to set up strong strategies for managing money in real-time. Make sure you have enough funds on hand for the new peaks in payment volumes. Be ready for daily sanctions screening. Mmake sure your Verification of Payee service is ready to confirm payee details across all channels. Finally, train your customers and staff to understand the new systems and processes.

There is a huge amount of work to be done for the SEPA regulations. And we’ve not even covered the 2025 SEPA Credit Transfer and SEPA Direct Debit rulebook.

What’s next?

As the SEPA Instant Payment scheme expands, there’s an ongoing debate about consolidation. If a single scheme—such as SEPA Instant—can process both high and low value payments faster than Target 2 and the traditional SEPA scheme, there’s arguably no need for anything other than SEPA Instant. The main drawback, of course, is that the existing schemes have further reach. But there’s a lot that could be gained by streamlining operations. SEPA Instant could serve as the backbone for euro settlement.

I’m a bank struggling with SEPA Instant. What should I do?

Speak to RedCompass Labs. It’s not too late to get back on track, but time is running out.

A lot of banks are facing challenges with their bulk payments systems, especially as they try to implement real-time fraud detection and VoP tools. For corporate banking, the lack of ready infrastructure for processing outbound payments instantaneously is a bottleneck that will need to be addressed. If this sounds like you, we can help.

We are payments modernization experts. We can guide you through the changes and implement solutions that can handle the increased volume, complexity, and speed of SEPA Instant Payments.

[Editor’s note: This article has been updated to clarify that the EDS will store technical information on where banks can find details about other interested parties.]

Share this post

Written by

Pratiksha Pathak

Head of Payments, RedCompass Labs