While blockchain can and will solve many problems that banks struggle with nowadays, not every innovation that developers deliver is invented by them. In many cases, existing banking solutions are implemented in a new field: blockchain and distributed ledger technologies.

It can’t be forgotten that building these banking concepts on a blockchain is incredibly tough. Every day, projects struggle to deliver their promises in time, and not to mention reaching the right security levels. Nevertheless, many of the key concepts that underpin the blockchain world are drawn from the very known legacy payment sphere.

To illustrate this, let’s contrast cross-border payments with how cross-chain transactions are sent between different blockchains.

Cross-border payments

First, you have to understand that a specific currency can only be moved to banks in that currency area. But what does this mean in practice?

Say you have GBP in your account. Your money can be moved only to ‘the border’ of the UK (or, more precisely, the UK banking system). Likewise, when you use PLN, you can only send it to ‘the border’ of Poland, while EUR can be transferred within just the Single Euro Payments Area.

You might counter this point by bringing up the existence of multicurrency bank accounts, offering myriad currencies on top of your main one. And yes, you are right. Nowadays, this is a standard solution that banks offer. But the truth is that the ‘real’ money is stored in the corresponding bank. If you see PLN as an option for your UK bank account, that money is actually in the Polish banks.

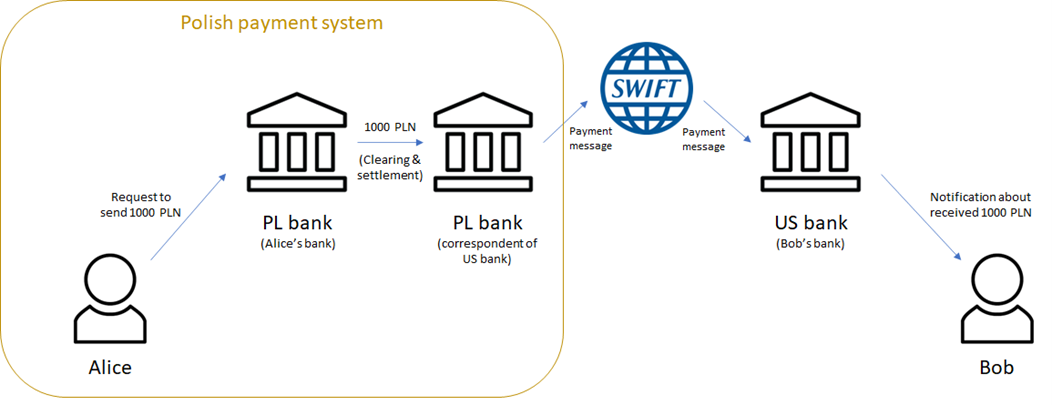

This is called ‘corresponding banking’, and cross-border payments are based on this concept.

When Alice sends 1,000 PLN to Bob, who is American, then the ‘real’ money is stored in Poland in one of the Polish banks with which the US bank has an agreement. The Polish bank, in this case, is called a correspondent bank. It holds money for Bob and his bank and promises that whenever they want to use the funds, the Polish bank allows it.

PLN can only be sent within the Polish payment system. Therefore, to send a transaction in PLN abroad, banks have to use their correspondent bank(s).

Whether we send a transaction in foreign currency or want to make a FX conversion, the principle is always the same: money in a specific currency can never go beyond its currency region/banking system.

Cross-chain transactions

What about the blockchain world? As you may have already guessed, its solutions are inspired by banking. Until the transaction is being sent within one blockchain, the payment path is straightforward – going directly from the sender to the receiver. The problem occurs when we want to send a transaction to a different blockchain, which happens routinely.

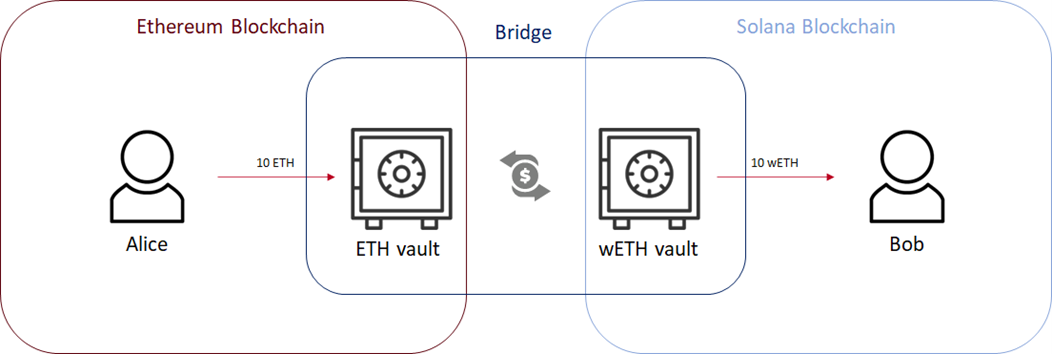

As in the banking world, cryptocurrencies can only be moved to the edge of their own blockchain.

In the blockchain world, the equivalent of the correspondent bank is usually called ‘the bridge’, as it forms a bridge for our funds to move to a different blockchain. Despite the name, our coins are not literally moved to another blockchain. For example, when we send Ether (the Ethereum blockchain coin) to the Solana blockchain, the Ethers are sent to a different Ethereum wallet, and only their equivalent is sent to the Solana blockchain. Sound familiar? It’s interesting that new technology, in some cases, replicates the same barriers as existing solutions.

Let’s take a closer look at what is meant by ‘equivalent’ on the Solana blockchain. These are usually called wrapped tokens and are kind of a promise that whenever we come back to our bridge and send back the wrapped tokens, we will be able to get ‘the real’ tokens on the proper blockchain.

It is also like this in the banking world. When we hold USD in our Polish account (so in practice, our USD are somewhere in a US bank), we also have a promise that whenever we want to use them, the bank in the US will allow us to do that. But what if a bank goes bankrupt? And what if ‘the bridge’ is exploited?

The same concepts, the same problems.

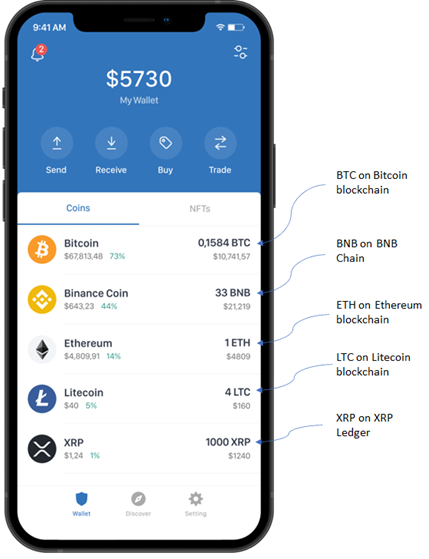

Of course, moving funds to different blockchains can be hidden in different ways under certain interfaces. Whether it’s a crypto exchange, mobile wallet or the official bridge of some big blockchain, coins must always be locked somewhere on the blockchain ‘border’ as others are released. And in many interfaces, users won’t see any wrapped tokens, just that the crypto payment was successful. In that way, it is exactly the same as in the banking world.

Source: trustwallet.com; All the coins are in one wallet in the crypto wallet interface, but each currency is on its own blockchain.

It is also worth mentioning omnichain protocols. We can treat them as upgraded bridges that are trustless and allow us to move funds between different chains. It is a fascinating concept that still uses the correspondent banking idea. However, it is so efficient and almost unnoticeable that we can call it a proper interoperability solution.

Summary

Even though many concepts in the blockchain world are taken from banking, it doesn’t mean that they can’t be developed further there. Omnichains are an excellent example of known solutions implemented in an upgraded way.

Nevertheless, it is still important to remember that crypto developers create many innovations, and some parts of crypto could stand to revolutionise the whole financial world. Contact us to learn how RedCompass Labs can help your organisation be part of this digital transformation.

Share this post

Written by

RedCompass Labs

Resources