European instant payments regulation: what’s new and what it means for Banks

The European Commission just published a press release regarding the upcoming instant payments regulation. We’ve reviewed the proposed Regulation and analysed what this good news for European consumers means for their Banks.

European legislators have long sought to make instant transactions “the new normal”. In doing so, they seek to further integrate the Single European Payments Area, promote a stronger international role for the euro and, at the same time, decrease the region’s reliance on foreign payment schemes.

To that effect, the European Commission has introduced a draft regulation to amend the Single Euro Payments Area (SEPA), which sets out a series of drastic measures to effectively replace traditional SEPA transfers with their instant variant. Additionally, the regulation seeks to oblige payment service providers to make a “confirmation of payee” scheme available to their customers to combat authorised push payment fraud.

Although this is a welcome move for European consumers, it throws up all kinds of challenges for payment service providers. Here’s what you should know.

The political context

In 2020 the European Commission established a four pillar strategy on retail payments to achieve the following objectives:

- That citizens and businesses in Europe benefit from a broad and diverse range of high-quality payment solutions, supported by a competitive and innovative payments market and based on safe, efficient and accessible infrastructures.

- That competitive, home-grown and pan-European payment solutions are available, supporting Europe’s open strategic autonomy.

- That the EU makes a significant contribution to improving cross-border payments with non-EU jurisdictions, including remittances, thereby supporting the international role of the euro.

The strategy’s first pillar focuses on developing pan-European transaction solutions built on instant payment rails. This will help the EU to promote autonomy, as there’ll be less reliance on foreign payment giants such as VISA and Mastercard. In addition, reducing friction for European consumers by stimulating instant payments reduces the threat of new entrants in the region. At the same time, this encourages customers to continue using classic payment service providers rather than turning to difficult-to-regulate virtual asset service providers.

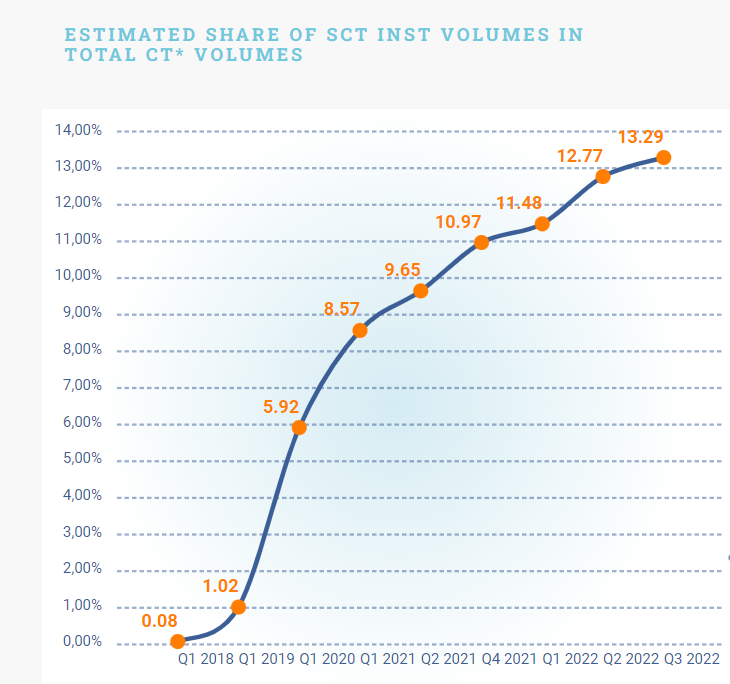

Despite the EU and the European Central Bank’s best efforts to promote instant payments and stimulate Target Instant Payments Settlement (TIPS), only 25% of European BICs are currently instant reachable and instant payments account for less than 13% of all European credit transfers. To accelerate this shift, Mairead McGuinness, the European Commissioner for Financial Stability, Financial Services and the Capital Markets Union, announced that a legislative proposal would be introduced in the second half of 2022.

Source: EPC

During her speech at Sibos’ opening plenary, McGuinness hinted that the proposal would cover the following areas:

- Measures to promote the widespread use of instant payments.

- Instruments to ensure that instant payments are priced proportionately and no longer a premium product.

- The development of safeguards to reduce the risk of fraud and errors.

- The deployment of an efficient and standardised sanctions screening process.

The proposed legislation

On October 26th the draft regulation was published, providing clarity on how the European Commission would achieve the legislative agenda detailed by McGuinness.

Before becoming law, the regulation will need to be reviewed, likely amended, and approved by both the European Council and the European Parliament. “There is a great deal of variance in how long this process can take, but it would be reasonable to expect it to take between 12 and 24 months for this specific piece of legislation,” says Jimmie Franklin from Vixio Payments Compliance.

The regulation only applies to credit institutions. Electronic money institutions (EMIs) and payment institutions (PIs) are excluded from the scope. Some may criticise the European Commission for appearing to regularly give the same rights to EMIs and PIs as banks (eg, as with PSD2), but they are apparently not subject to the same obligations.

The legislation covers four topics:

- Mandatory provision of instant credit transfers in euros

All credit institutions that process customer credit transfers will need to be able to send and receive instant payments. The introduction of these requirements will be staggered at certain time points in the euro area following the regulation entering into force:

- At 6 months: receiving instant payments in euros for payment service providers (PSPs) in the euro

- At 12 months: sending of instant payments in euros for PSPs in the euro area.

- At 30 months: receiving instant payments in euros for PSPs outside the euro area.

- At 36 months: sending instant payments in euros for PSPs outside the euro area.

The preambles of the regulation stipulate that it applies to all customer interfaces, including those allowing for bulk payments. Although there is some debate as to whether interfaces such as SWIFT FileAct would fall under its scope, the spirit of the legislation indicates that it certainly does.

- Charges in respect of instant credit transfers

All credit institutions that process customer credit transfers will provide instant payments to their customers no higher than the cost of a regular SEPA credit transfer. This stipulation enters into force 6 months after the regulation for eurozone banks comes into effect.

- Discrepancies between the name and payment account identifier of a payee in case of instant credit transfers

Banks will need to deploy a service that allows payers to validate that the account name and account identifier (eg, IBAN) match prior to authorising the payment, commonly referred to as the confirmation of payee scheme. Again, this stipulation applies to all user interfaces that a bank provides for initiating credit transfers. Banks will need to comply with this within 12 months of the regulation coming into force.

Ensuring interoperability and coverage will be a challenge, and RedCompass Labs believes it is a missed opportunity that the European Payments Council was not explicitly mandated to develop a pan-European scheme. It seems that the Commission has not learned from its mistakes in PSD2: open banking adoption was significantly slowed due to the lack of API standardisation.

- Screening of PSUs regarding Union sanctions in case of instant credit transfers

Banks will need to conduct daily reviews on whether any of their customers are sanctioned persons or entities. They will, however, no longer need to do sanctions screening for instant payments, even when doing so cross-border.

This approach seems to close the door on “one leg out” SEPA transfers, which have been piloted with initiatives such as IXB.

What are instant SEPA credit transfers?

SEPA instant credit transfers, otherwise known as SCT Inst, are European real-time payments that adhere to the associated scheme from the European Payments Council. This scheme defines the interbank messaging that adherents should use and requisite service levels.

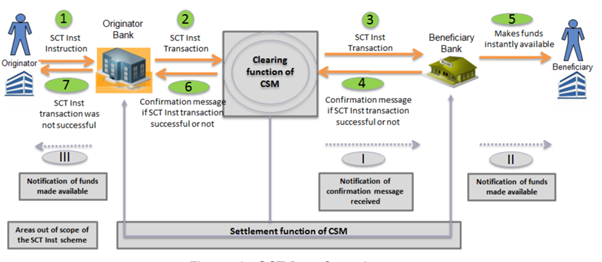

Source: EPC

The primary difference between a traditional SEPA credit transfer and an SCT Inst is that the funds are to be made available to the beneficiary within 10 seconds of the SCT Inst instruction, which is confirmed using interbank messaging. This means that SCT Inst transactions are processed on a unitary basis rather than being bulked like SEPA payments. The EPC has set EUR 100,000 as the maximum amount for a single SCT Inst transfer.

With real-time, 24/7 payments, SCT Inst allows for new use-cases. For instance, late and weekend transactions, as well as payment versus delivery scenarios (ie, point of sales and point of interaction), are now possible. When combined with Request to Pay, instant payments are poised to be a compelling and cost-effective alternative to processing over card rails.

Clearing and settlement

There are various clearing and settlement mechanisms that support the SCT Inst scheme. Eurosystem’s market infrastructure for instant payments, TIPS, is pan-European, and serves not only to clear and settle transactions, but is also used to fund and defund accounts at all other SCT Inst market infrastructures. All SCT Inst participants are required to have a TIPS account and must be able to process transactions they receive over this market infrastructure. Connectivity to TIPS is ensured through the European Single Market Infrastructure Gateway, which is also used by Target 2, T2S and ECMS.

SCT Inst participants can also become members of other instant payment infrastructures such as EBA Clearing’s RT1, which has pan-European reach, as well as the numerous domestic market infrastructures. Some of these domestic market infrastructures have developed variants on the EPC’s rulebook. Examples include non-time critical instant payments in the Netherlands (with a longer time-out than traditional SCT Inst), as well as Belgium’s variant of instant payments that have an uncapped maximum amount and an SLA of 5 seconds.

Due to the low account maintenance fees charged by most clearing and settlement mechanisms, most credit institutions opt to connect to instant market infrastructures either as a direct participant, or as an indirect participant through a group hub. Indirect participation outside of a banking group is only very rarely encountered in SCT Inst clearing, and often does not make much economic sense.

What are the challenges?

Developing instant payment capabilities is not a straightforward task. In addition to developing messaging capabilities, banks need to ensure that their end-to-end payments architecture is real-time capable. This includes putting in place payment channels, sanctions screening systems, fraud detection mechanisms, payment engines and accounting systems, not forgetting the middleware that forms the glue between these systems. In other words, wherever batch-based processes were used, the bank will need to replace these with real-time ones.

Instant payments should be available 24/7 throughout the year. This means that banks not only need to design and test for resilience, but they will also need to consider how software updates are released and how maintenance is performed throughout their payment processing value chain without disrupting services.

Payment service providers need to carefully assess their required capabilities for sending and receiving instant payments, measured in transactions per second. Whereas payment service providers have some level of control over their volumes of outbound payments, this is not the case for inbound transactions. The first banks have started supporting file-based instant payment initiation, which can lead to large spikes in incoming SCT Inst volumes across the market.

Finally, payment service providers will need to consider how they need to adapt their operating models to support 24/7 payment operations. Whereas liquidity management can largely be automated by setting liquidity floors and ceilings in the market infrastructure, processes such as customer support and monitoring may require around-the clock staffing.

The most significant challenge, however, is that the proposal appears to enforce a no-cost-added instant option for payments initiated as bulk. Some bulk payment files initiated by corporates, such as payroll providers and pension funds, can contain hundreds of thousands of payments. If these were processed as instant payments, even the largest banks and clearing and settlement mechanisms would need to massively scale their infrastructures to be capable of processing at the required number of transactions per second. We would expect some additional clarification to be added to the regulation to put some safeguards in place to prevent these capacity issues.

Confirmation of payee

Whereas card schemes have well-established chargeback procedures, this is not the case for instant payments. An instant payment, once executed, is irrevocable, much like a regular SEPA Credit Transfer. However, due to the speed of these transactions, successfully recalling an erroneous or fraudulent payment has a much lower probability of success.

Introducing a confirmation of payee requirement allows payment originators to verify the match between the account number and the name of the beneficiary, thereby being alerted to certain forms of financial crime such as invoice and WhatsApp fraud.

Although domestic account validation schemes exist in various European jurisdictions (including the Netherlands, France, Italy, Spain, and the Nordics), developing an interoperable, cross-border scheme will ensure that these forms of criminality can be more effectively prevented. The timelines to develop such a scheme are quite short, so the industry will need to quickly align on a coordinating party.

Conclusion

The proposed legislation is extremely ambitious in terms of timelines and scope. Although there are likely to be some compromises under pressure from industry interest groups, banks cannot afford to wait to start reviewing their instant payment capabilities. Banks that are not yet SCT Inst capable need to start developing a roadmap, and banks that do propose the payment method need to assess their capacity limitations, as well as how they will propose the method across all payment initiation channels.

More information:

Press release

Frequently Asked Questions

Timeline

Text of the proposal

Impact assessment

Watch the press conference

Sources:

https://www.europeanpaymentscouncil.eu/what-we-do/sepa-instant-credit-transfer

Mairead McGuinness’ speech at Sibos Opening Plenary, 10/10/2022

Share this post

Written by

RedCompass Labs

Resources