Later this year, hybrid addresses will be introduced as part of the ISO 20022 migration, following industry recommendations (including Swift’s Payments Market Practice Group (PMPG)).

The new format will solve several issues with both fully structured and unstructured address fields (click here for a full overview of the what and why). But they also bring major challenges to banks’ internal systems and customer-facing channels. With the deadline approaching, now is the time to start preparing.

So, what’s the best way to get ready?

1. Check the deadlines

The hybrid address rollout will start toward the end of 2025.

For SEPA (Single European Payments Area), hybrid addresses will be introduced on October 5, 2025, while CBPR+ (Cross-Border Payments and Reporting Plus) and HVPS+ (High Value Payments Systems Plus) schemes will follow on November 22, 2025. Up until November 2026, banks may send or accept all three address formats—structured, unstructured, and hybrid. However, after November 2026, unstructured addresses will be phased out altogether.

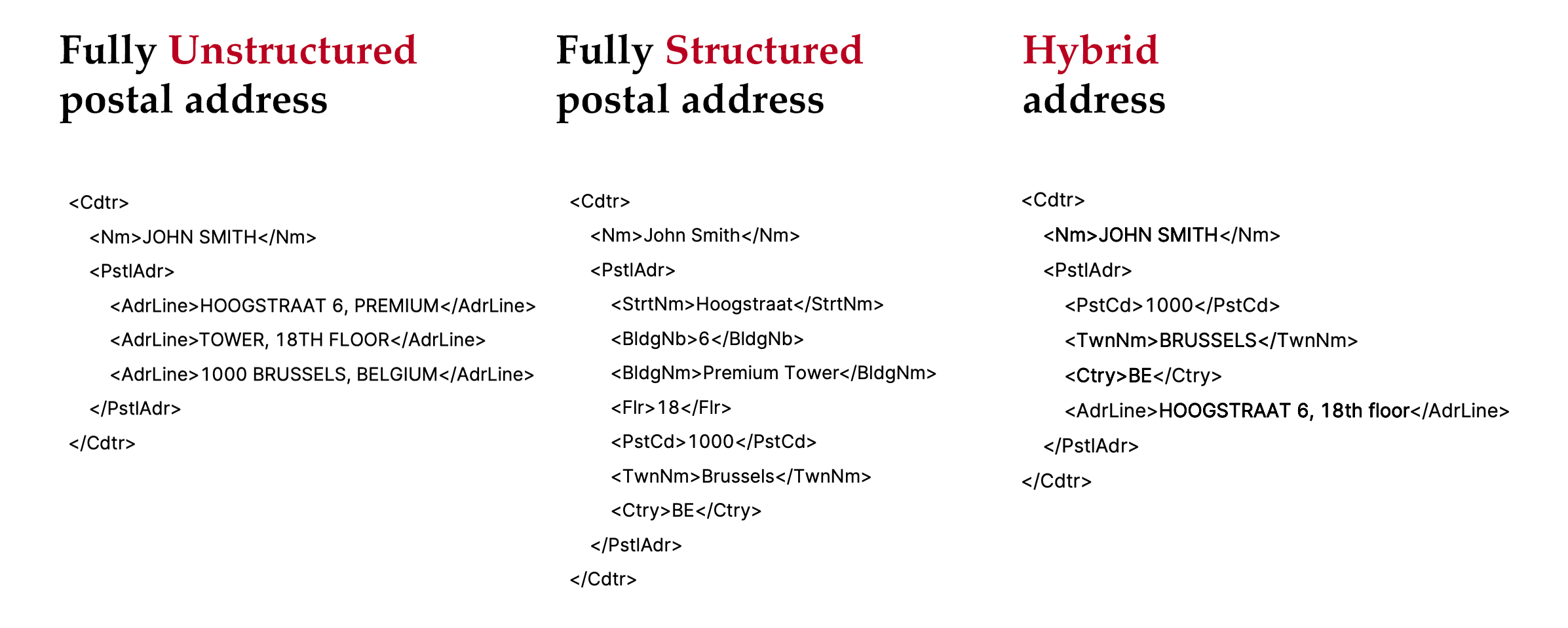

Image: Unstructured, structured and hybrid addresses

For European banks, particularly those with shared back-office or payment engine systems across SEPA and CBPR+/HVPS+ schemes, this presents a unique challenge. Banks must ensure their systems can process hybrid addresses for SEPA payments while continuing to handle non-hybrid addresses for CBPR+ and HVPS+ during the transition. That means there’s a slightly tricky period to navigate on top of the already challenging migration.

2. Understand if you will be impacted (spoiler: you will be)

As a bank, you may have decided that transitioning to hybrid addresses is not necessary for your customers. You might not often send payments using hybrid addresses, or perhaps you don’t bank in a region where it is required. But that does not mean you are exempt. You will still need to accept hybrid address formats from other banks, and you must give your customers the option to send them as well.

That means you’ll need to update your customer-facing systems to collect, process, and validate hybrid addresses to meet compliance. That includes file-based bulk payments for corporate banking, fraud and sanctions screening, APIs, Open Banking, online and mobile, and customer support.

3. Conduct an impact analysis

Once you’ve established the impact, look at every system that will be affected. Think customer-facing channels and Enterprise Resource Planning Systems (ERP– things like finance, treasury, procurement, and reporting), but also back-office systems such as payment processing systems (like your payment engine and core banking), treasuring management systems (TMS), risk and compliance (including anti-money laundering, fraud and sanctions screening), and regulatory reporting (tax and regulations).

Start with your customer-facing systems (like client onboarding) and then focus on your back-office (processing) and payment systems (execution).

4. Review your back-office systems and payment engine validations

Next, take a deeper dive into your back-office systems. ERP (Enterprise Resource Planning) and TMS (Treasury Management Systems) contain libraries of customer data. The challenge here is that most only use free-text fields –unstructured data. They cannot support hybrid (or structured) addresses. You may need to update or replace your systems.

If you have traditional validation rules—which restrict addresses to either structured or unstructured formats—you’ll need to relax them to accommodate the hybrid format.

Existing validations and configurations will need to be reviewed and updated to ensure they’re compatible. This applies to payment requests from customer channels and transactions received from clearing houses or correspondent banks.

5. Update your customer data

Then, add some structure to your customer addresses. You’ll need to migrate existing unstructured addresses into a hybrid or fully structured format. And all new data must be structured.

This will take time. You should align the new address formats across every part of your business, from onboarding systems to core banking and back-office systems. Artificial intelligence can help, but it won’t do the work for you. You’ll need to check every address has been properly formatted for it to work. And you must work closely with vendors, partners, and industry bodies to ensure data flows across all platforms. Failure to do so could lead to rejected payments, noncompliance, and delays in payment processing.

Take a unified approach. Look at every system and every bank of customer data. Update them all at once so they work across internal systems. Try to move to fully structured addresses where possible.

Upstream and downstream systems processing

It may be helpful to map the impact in terms of upstream and downstream systems. Upstream systems don’t create payment messages, but they handle and store the payment information, which triggers processes that impact the whole payment journey. Downstream systems receive and act on the data, meaning they process payments, check compliance, and complete transactions. In other words, getting the upstream right means fewer errors in the downstream.

Start with upstream systems (data entry and origination)

-

ERP & Vendor Management

-

APIs & Open Banking Interfaces

-

Core Banking System (CBS)

Focus on downstream systems (Processing & Execution)

-

AML & Sanctions Screening

-

Reconciliation & Treasury Systems

-

Regulatory Reporting & BI Tools

Thinking Ahead

By November 2026, banks must have fully transitioned to hybrid or fully structured addresses. There will be no more reliance on unstructured data or partial implementations. It is absolutely essential that banks start work in 2025 to be ready in time.

The transition to structured addresses isn’t just about meeting compliance—it requires a fully integrated, long-term strategy involving investments in technology, training, and process redesign. Banks that fail to implement the necessary changes risk compliance issues, operational inefficiencies, and disruptions in customer experience.

If you’re stuck, speak to RedCompass Labs.

Share this post

Written by

Arun Kumar Saravanan

Business Analyst, RedCompass Labs