My grandma is a tough cookie. She always gets what she wants. After hearing in the news that the Pfizer vaccine was better, she negotiated with her GP not to take the AstraZeneca one. On another occasion, she lied about her identity, pretending to be ‘Madame Robin‘, just to complain about a cake that she bought and that was not in line with her expectations. As a result, I have literally never worried that she lives far away from all other family members. Of course, from time to time, my mum would say, “she has Alzheimer’s. She gave me a €50 banknote asking me to exchange it for €20 in coins!“. Ah well, which daughter-in-law doesn’t think that about their parents-in-law?!

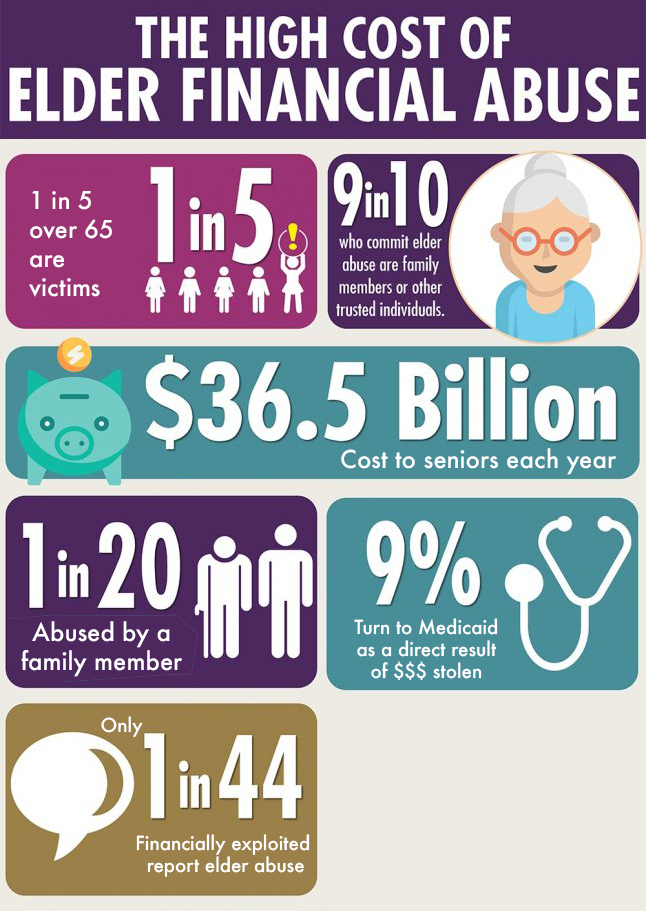

I then watched I Care a Lot, where Rosamund Pike traps seniors into being their legal guardian to drain their savings. Of course, I started to wonder: could my grandma fall into a similar trap? As a business analyst by trade, I went online straight away to gather more information. Why would I think that was a good idea? I quickly discovered that fraudsters were often targeting seniors. By the end of 2020, fraud scammers had conned over $1 million from seniors in the Northern District of Ohio alone. I mean, $1million in a tiny part of Ohio! Imagine how it must be in Cote d’Azur, Florida, and other areas where there is a high concentration of senior inhabitants. Out of pure coincidence, my boss shared the following infographic with me around the same time too. That got me seriously thinking, and two conclusions stood out.

Source: The Knoble, Elder Protection Center and US News & World Report

Can we say bye-bye to cash, please?

Actually, protecting seniors is yet another reason for moving from cash to digital payments. It is almost impossible to detect the abuse committed towards seniors, particularly so where a family member is involved, as is the case in 9 out of 10 incidents of seniors abuse. No one will ever notice the €10 disappearing here and there… With digital payments, every single movement of funds is reported. Machine learning can then be used to analyse patterns and detect red flags for potential abuse.

Let’s have neobanks that target seniors!

As a payment specialist, I often get asked, “where can banks generate more revenues?“ especially when running a RedCompass Labs Future of Payments workshop. Well, by developing a product position that specifically targets seniors! In their annual report, McKinsey mentioned that banks should focus on specific business segments. The senior market is huge already, and in most developed countries will continue to grow with the ageing population. With lots of neobanks targeting youngsters, this deemed golden segment is now overcrowded. In less than a month, we have seen banks targeting the black, LGBT, and Asian communities – even dog owners! It is time to target seniors. If incumbent banks think that because neobanks don’t have branches, they can’t target seniors, they are wrong. With COVID-19, the world has moved online.

And so have seniors, who are now communicating through Zoom or making use of internet banking. Except for Longevity card, no one seems to be targeting this segment. In a previous article, I said I would never quit my job to create a neobank. Well, if it is a bank targeting senior, I might very well change my mind (just kidding, boss).

Share this post

Written by

RedCompass Labs

Resources