What does this mean for banks, though? If you’ve been reading our blogs, you know that we love to make your busy life a little bit easier. So, as usual, we have not only read the report, but also distilled two take-aways and a “so-what” for you.

Pay.UK ISO 20022 Consultation: The Results

Let’s start with the report itself. The consultation closed on 28th April 2020 and involved a range of financial institutions, service providers, end user representatives and other interested parties. The conclusions can be summarised in the following two take-aways:

1. Pay.UK will continue to prioritise ISO 20022 for the New Payment Architecture core clearing and settlement capability. In this sense, they will continue to work “closely with the Bank as operator of CHAPS (and RTGS) to ensure close alignment with CHAPS.”

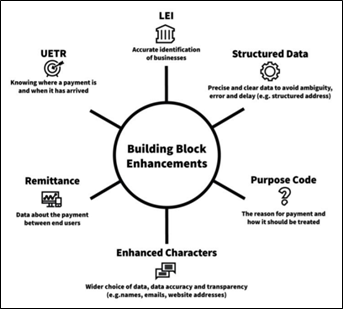

2. The industry agrees that the Data Enhancement Building Blocks [see image below] proposed by Pay.UK as part of their migration strategy will bring significant benefits for participants, businesses, individuals, and government departments alike. So, what does this mean for banks?

From Pay.UK “Next Generation Standard for UK Retail Payments”

From Pay.UK “Next Generation Standard for UK Retail Payments”

Pay.UK ISO migration: how banks can transform the unexpected into opportunities

While the report is an injection of positivity and motivation towards the implementation of ISO 20022, the push from Pay.UK echoes the importance of a thoroughly planned migration strategy. Without a migration strategy, banks risk creating a competitive disadvantage for their payment services, blocking their digital roadmap and, even worse, failing to comply with the regulator’s demand. Someone said:

“Unawareness can make any event an accident. Awareness can turn every event into an opportunity.”

So here are 3 events brought by ISO and how to transform them into an opportunity:

1. Unambiguous Identification

The introduction of Legal Entity Identifiers (LEI’s), contextual information (i.e. purpose codes) and structured invoice references will finally help banks to protect their customers from fraudsters, avoid payments outages and support corporates with more structured information.

Existing standards often leave too much room for partial and/or ambiguous payment information. As a result, banks aren’t able to understand the nature of the payment or to properly identify the parties involved in the transaction. This, of course, has a knock-on effect on customers as the bank will have to stop the payment for further investigation or risk not being able protect their customers from potential fraudulent payments.

Corporates, on the other hand, are spending a lot of effort and money on reconciling payments with outstanding invoices, as they do not have access to enough (structured) information.

ISO 20022 will tackle these challenges. However, to enjoy these benefits, banks need to ensure that their end-to-end payments infrastructure can support the extended structured information included within ISO 20022 messages.

2. Innovation driven by a flexible standard

During the past few years, we have seen many great digital innovations in the payment initiation space, such as QR-codes or alternative accounts identifiers like license plate numbers. All these solutions aim to improve the customer’s experience by making it frictionless and invisible.

ISO 20022 message formats will support further innovation as they are flexible and extensible. In fact, it will be easier to introduce new pieces of information and new character sets in the future.

However, banks need to ensure that the end-to-end payment chain can carry the additional information. If not, there is risk that digital innovations will not be supported or can only be supported against high costs that involves legacy system integration – a process which is akin to “unravel” a pile of spaghetti.

3. Transparent and traceable payments

Today’s customers want invisible, frictionless payments as well as more transparency from their banks on how their payments are being processed, which costs and margins are applied, and where they are within the payments chain. To achieve this, SWIFT introduced a Unique End-to-end Transaction Reference (UETR) that allows to trace a payment back at any point in time. By adopting the same concept, Pay.UK is forcing all UK banks to implement the same reference in their commercial payment flows.

Here, banks have a great opportunity to innovate and simplify (which, as we always say, is one of the 5 things that banks should do while migrating!). In fact, UETR can also be used by internal departments for things like claims and investigation procedures. Blindly implementing the new standards without considering the added value of this reference for other parts of the business will impact the bank’s capacity to innovate.

To conclude, we would like to remind you that in 2021 and 2022, Pay.UK will publish the standards for various payment schemes. Our mantra will be the same: banks will need to be on top of these standards to ensure they properly understand their impact as well as how these changes will allow them to innovate.

Delaying, underestimating the risks or failing to leverage regulatory spend to innovate will make banks loose ground to other players from the growing digital ecosystem that are already leveraging the lower costs and thinner regulatory burden to win market shares.

Needless to say, we will be ready to support you with our summaries, videos, in-depth analysis and, if you’d like, with your payments change expertise and data-led technology.

Share this post

Written by

RedCompass Labs

Resource

ISO 20022 Migration: 5 must-haves for success

Wondering how banks can ensure a timely and successful migration? Download the "ISO 20022 Migration: 5 must-haves for success" whitepaper.

Download nowResources