Last week, I froze in front of the digital screen at the supermarket self-checkout. I did not want to touch it, conscious of the potential COVID-19 germs that might be lurking on it. Truth be told, I had entered the supermarket full of confidence – excited almost – because I had just downloaded the supermarket’s app. I thought: “yesss, I can just ‘scan, bag and go’”. Except that I could not pay with the app, so in order ‘to go’ I had two options to choose from:

- Option 1: self-checkout and touch the (potentially infected) screen, or

- Option 2: queue for a long time with my two-year old son running everywhere and seek help from a cashier.

Obviously, I picked option 1, but I panicked. My son noticed that something was wrong and kindly offered to pay for the groceries with his Peppa Pig credit card, a card made of paper.

This experience and particularly my son’s reaction got me thinking. When I was a child, I would have tried to rescue my mum with fake cash, like Monopoly banknotes.

My son, instead, tried to help me with his Peppa Pig credit card. That’s quite a generational shift. But the real question is: what type of help will his children offer? Well… none! Because payments will be so embedded that this situation will organically not happen anymore.

For the doubting audience – yes, I am looking at you, boss – adoption of contact-free payments is growing faster than anyone could have anticipated. In 2019, the Bank for International Settlements (BIS) reported that ‘a quarter of payments are initiated by non-banks already.’ In their 2020 Global Payments Report, McKinsey affirmed that ‘all forms of electronic peer-to-peer and consumer-to-business payments have been boosted’. In some countries, the brand names of the apps that enable digital payments have already become part of everyday language. For example, in Sweden, people ask “can I swish?”, while in France they say “I will Lydia you” to indicate they will perform a peer-to-peer payment or scan the QR code in store.

Retailers are also jumping on the bandwagon and using banking-as-a-service[1] to offer nimble experiences or partner up. In less than a month, both Walmart and Ikea have announced they were seriously entering the payments space. If you think that Ikea magazine was as popular as Harry Potter or the Bible, you can see how the retailer has some superpowers to rapidly change the way we pay forever.

Now, let’s get to the meat. Will cards be part of the embedded payments journey of the future?

If you ask me, I am not too sure.

FinTechs have paved the way for innovation and released solutions that enable clients to collect or pay more easily without a card. For example, Trilo offers card-free QR code payments in store. Bankifi developed a Request-to-Pay[2] product that can be plugged on top of instant payment schemes, with no cards involved. Google just introduced a new feature that enables consumers to pay for parking and transit fees within Google maps by using cards (ok, I’ll give you that…) or (here we go…) their Google Pay account.

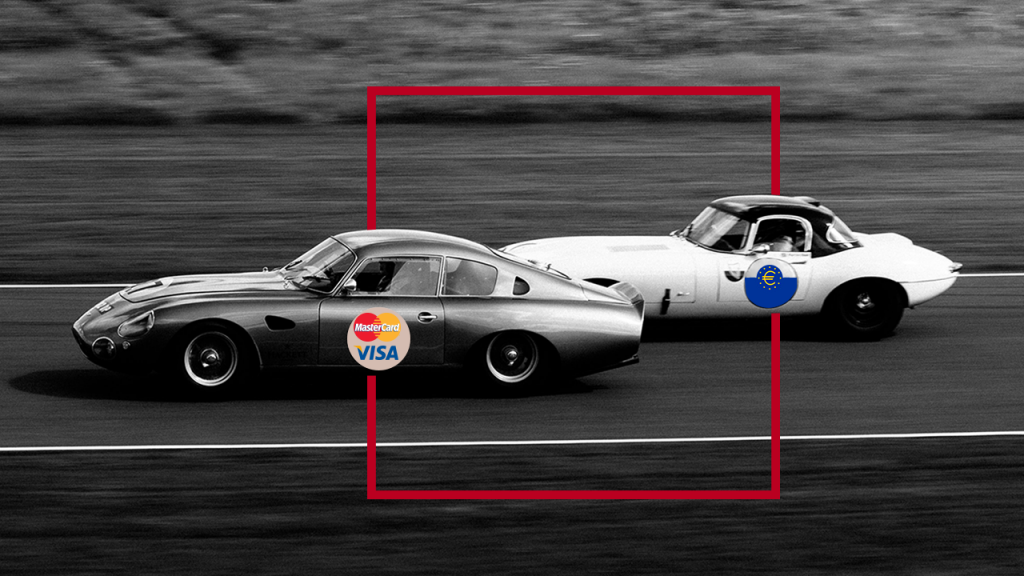

Big card giants Visa and Mastercard have also spotted the trend and, fearing that cards may not be part of tomorrow’s world, they have started to invest in real-time digital payments ecosystems.

What about the big banks? Well, many major ones, like Lloyds, NatWest, and HSBC are also starting to offer revolutionary and more convenient services, and to completely remove cards from the end-to-end flow by using Open Banking[3] as an enabler.

Not convinced yet? Look at Asia, where QR-code scanning is part of people’s daily life and where people pay retailers using Central Bank Digital Currency. In fact, the revolution has already started in the UK. If you live in London, go and check Amazon Go, the Big Tech’s checkout-free store in Ealing!

Ok, I think you’ve got the point. Now, there’s only one question left: will the term ‘branch’ disappear from the dictionary because bank branches simply won’t exist anymore? For my part, I decided not to teach it to my children. And it looks like HSBC and I are on the same page in anticipating the future…

[1] The definition of banking-as-a-service is available here

[2] Request-to-pay is an overlay on top of existing payments infrastructure and it offers a new flexible way to manage and settle bills between businesses and organisations as well as among friends. More information available here: https://www.requesttopay.co.uk/

[3] To be understood in the context as a way to exchange payments data through Application Programming Interface.

Share this post

Written by

RedCompass Labs

Resources