Real-time payments (RTP) are payments that are initiated and settled within a few seconds. The funds are available to the payee instantly and both parties of the transaction get instant confirmation. They should also be able to be executed at any moment – 24/7, 365 days a year.

Moreover, the real-time payments network should be an open-loop, i.e. onboarding to a private network should not be mandatory. Nowadays, the market offers us e-wallets that provide real-time payments. However, most of them are closed-loop networks and require both parties of transactions to connect to their platforms, and they are not classified as RTP.

Real-time payments are a convenient way of making transactions. They are faster not only in terms of the settlement process but also in terms of initiation. Web, smartphones, and other channels can be used to provide essential data, which often are reduced to, for example, a phone number or an ID.

Let’s have a quick look at the numbers. According to the GlobalData measures, about 118 billion real-time transactions were conducted in 2021. Almost 428 billion are expected annually by 2026, which would be over 25% of all global electronic payments. The Centre for Economics and Business Research (CEBR) conducted a study across 30 countries that showed RTP generated an additional economic output of $78,4 billion in 2021. This figure is expected to rise to $173 billion by 2026. These figures clearly show that real-time payments contribute to economic growth, which is an important benefit.

Source: “Real-time payments and implications of the COVID-19 pandemic”, Deloitte

The benefits of real-time payments

To this point, some of the advantages of real-time payments were already mentioned. The obvious one is that the payment is fast. The younger generations, who were raised in the Internet Era, take the instant transfer of information as granted. Payments are no exception to this. But there is an even more important reason why fast payments matter. Thanks to real-time payments both small and large businesses have control over their cash flow and liquidity: It hugely improves their cash management and relations with suppliers. Offering real-time payment services opens a new stream of revenue for financial institutions as it attracts new clients and increases the volume of payments.

With rocketing number of gig workers, real-time payments also become more important. Thanks to them the employees are able to get their wages as soon as their work is done.

Both parties of a transaction benefit from the 24/7 availability, predictability, and transparency that RTP brings. The payer and the payee get the confirmation at the same time of the settlement. Real-time payments can be integrated with other systems to automate reconciliation.

RTP can replace outdated methods like paper checks in government-business relations. It will increase the efficiency of running businesses and make the whole process much easier and cheaper. Another benefit is the enrichment of data on payments. Increasing the volume of digital payments, which are easier to track, will give the payment providers powerful data for analytics.

The adoption and popularization of real-time payments will be one of the factors driving the market growth. According to a survey conducted by ACI Worldwide, 77% of merchants worldwide are expecting RTP to replace cards.

The challenges and costs

Although there are many substantial benefits coming from real-time payments, this market segment still has to face many challenges to reach its expected potential in, hopefully, the nearest future.

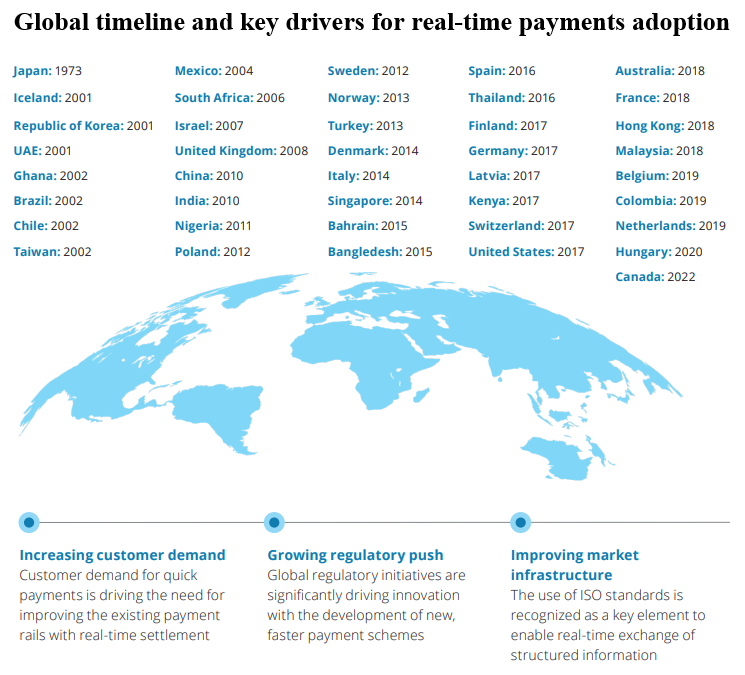

One of the biggest difficulties of today’s RTPs is that they are mainly local and are available only within one country or region, or just within one currency zone. There are a few reasons for this. The payment networks across the globe are still fragmented so it is harder for different RTP networks to communicate with each other. Central banks of particular countries want to control the payments under their jurisdiction, which is tougher if they go abroad.

The next reason is that consumers, businesses, and financial institutions across the world have different needs and expectations, which restricts the development of global RTP systems. The same problem applies to technology. Countries vary in the technology they use, so it is hard to create a universal system that could integrate RTP systems from different regions.

Today’s solutions connect a few countries at best, for example, there is a connection of RTPs between Singapore, India, and Malaysia. These problems in interoperability make real-time payments “closed-loops” rather than “open-loops,” which, as it was indicated earlier, should not happen.

This fragmentation of RTP systems makes it really costly. Financial institutions that want to participate in it have to invest money and a lot of time to connect to the network or networks if they want to offer cross-border services. Every state has its own jurisdiction and technical framework that banks have to conform to. Also, research on the market has to be done carefully to make sure that the business understands the needs of potential local customers.

All these problems result in B2B real-time payments still waiting to take off. The usage still remains at a low level despite the potential it has. The transaction limits are insufficient for the companies, which still requires them to use expensive RTGS systems. Big corporations do not fully trust RTP and whether they can provide the required security. Some banks do not invest in RTP systems as the margins there are typically lower than with RTGS services.

Summary

Summing everything up, real-time payments are a solution with great potential that may overtake a huge part of the market in the future. With its ability to initiate, settle and confirm the transactions within seconds, it is expected to significantly increase the efficiency and convenience of the payment users – and, eventually, even the global players who make cross-border payments. However, to make it happen, regulatory bodies and financial institutions have to face and solve many difficulties to provide the best service for all who want to participate.

Share this post

Written by

RedCompass Labs

Resources