Open Banking has been significantly impacting the financial world for a while now, and it is continuously evolving, allowing consumers advantage from data-driven financial services. While it allows sharing data stored within one organization with another organization, normally between financial institutions and trusted third parties, it gives customers or businesses greater control over their data and is secure and protects privacy. The Open Banking model could bring enormous value to society, improving the value propositions in payments, retail banking, and other finance segments.

The Euro Retail Payments Board (ERPB) had not stayed aside from the rapidly growing initiative and their Working Group has been developing a SEPA API Access scheme which would ‘focus on the exposure of non-personal bank-owned information, customer data, and customer transaction initiation services, while fostering innovation, increasing choice for customers and scheme participants. After the revised Payment Services Directive (PSD2) was implemented and the Working Group agreed on the commercial baseline, the aim of the scheme was to enhance the benefits of this directive by going beyond and adding premium services in the Open Banking context.

How it all started?

Two recommendations were outlined in the ERPB’s final report and one of them was to invite the European Payments Council (EPC) to take up the Scheme Manager role for payment accounts. Therefore, it was decided to establish the SEPA Payment Account Access Multi-Stakeholder Group (SPAA MSG) to facilitate the SPAA scheme creation and development.

What is the SPAA scheme?

The SPAA scheme is created according to the requirements stated in the ERPB’s Working Group June 2021 report on a SEPA API Access scheme and covers the set of rules, practices, and standards where the payment accounts related data exchange will be allowed and will facilitate the payment transactions initiation in the ‘value-added’ services context provided by Asset Holders (i.e. Account-Servicing Payment Service Providers (ASPSPs) to Asset Brokers (e.g. Third Party Providers (TPPs)).

It gives us an opportunity to help drive ‘open payments’ in the EU through a scheme-based approach that unlocks and creates value. whilst allowing for a fair distribution of value and risk between actors.

The SPAA scheme will enable ‘premium’ payment services beyond PSD2, ensuring harmonization, interoperability, and reachability across Europe.

The SPAA Scheme is not a payment instrument, it is simply a messaging eco-system that transfers payment accounts and transaction-related data between participating parties, whereas the actual payment is not part of the scheme. This is a complementary, voluntary scheme that is built using the legal and regulatory requirements of PSD2 as the baseline.

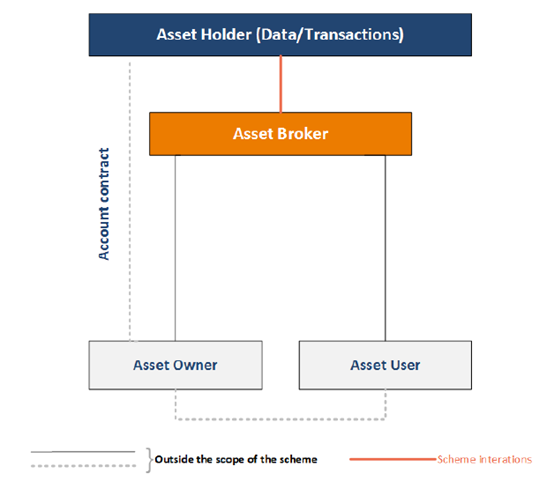

The diagram demonstrates the key actors that are involved in the processes. Only the Asset Holder and Asset Broker are the Scheme Participants, whereas the Asset Owner and Asset User are not. As mentioned earlier, Asset Holders are ASPSPs in a PSD2 context, i.e., banks and other institutions that offer payment accounts to the customers, and their role is to hold the asset owner’s asset(s). An example of Asset Broker is a TPP – an organization which uses APIs to provide account information services by accessing customer’s accounts, and it uses the Asset Holder’s asset(s) with Asset Owner’s consent, for delivering value to the Asset User. As for the Asset Owner, it is Asset Holder’s client and optionally Asset Broker’s, e.g., a legal entity or a consumer who owns the assets. Lastly, Asset User is only a client of the Asset Broker who uses the asset(s), payee/merchant – for transactional assets; legal entity/consumer – for data assets.

Main advantages of the SPAA scheme are:

- It is aligned with EU legislation as it is built, based on the PSD2 regulations that are taken into account

- It has a support from relevant EU institutions, is managed as a scheme, and is created cooperatively by the retail payment industry

- It enables value-added payment services beyond PSD2 in a way that ensures harmonization, interoperability, and reachability across Europe

- It allows data and transaction exposure from Asset Holders for Asset Brokers for a fee, after it has been permitted by Asset Owner

- It could be a stepping-stone towards ‘open finance’ beyond payments and ‘open data’ beyond finance.

What is next?

As of today, a public consultation was launched on the SPAA scheme draft rulebook developed by the SPAA MSG and facilitated by the EPC and it will last until 12th of September 2022. After the consultation is completed, the final version of the rulebook should be published by the 30th of November 2022, following EPC Board’s approval

Conclusion

With the rapid growth and evolvement of the financial world and Open Banking, SPAA scheme initiative indeed could be quite beneficial for the participating parties, giving the ability to provide new opportunities for clients and will allow new ways of income. At the same time, it would be a huge step towards open data and finance while complying with EU legislation. Overall, SPAA scheme could be the next big thing in SEPA as it would attract more parties to participate, and functionalities will be improving all the time according to the market demand.

Vocabulary:

API – Application Programming Interface

ASPSP – Account-Servicing Payment Service Provider

ERPB – Euro Retail Payments Board

MSG – Multi-Stakeholder Group

PSD2 – Payment Services Directive

SPAA – SEPA Payment Account Access

TPP – Third Party Provider

Share this post

Written by

RedCompass Labs

Resources