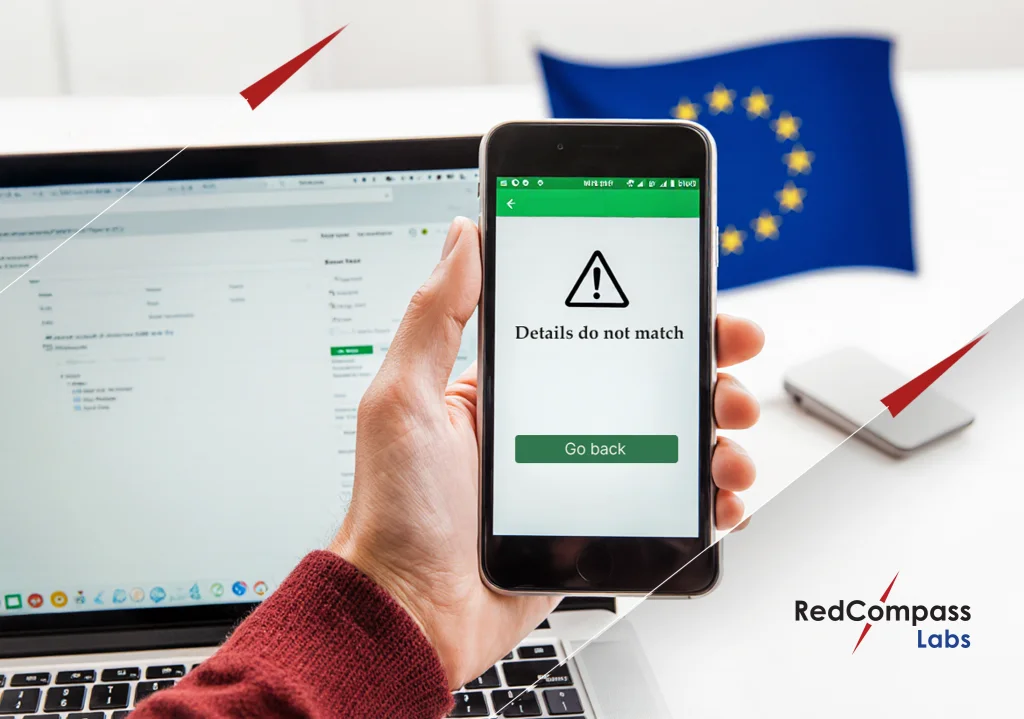

“Sorry, we can’t accept you as a customer.” I can’t count the number of times I heard this when trying to open an account with a next-gen investment robot advisor when applying for financial apps. No digital platform that provides automated, algorithm-driven investment management services, such as Moneyfarm, Nutmeg, or Marcus, or no app selling fractional stocks, like FreeTrade, wanted to take me as a customer. This is all because of my US citizenship and its related tax implications! Seriously?! And I am not even investing in NFTs.

Financial inclusion has always been close to my heart. Mike Truter and I have already discussed the challenges faced by the unbanked with Elisa Menischetti, and, more recently, Paula Hunter and Lesley-Ann Vaughan on the RedCompass Labs’ After Hours podcast. However, over the past few weeks, after experiencing this kind of obstacle first-hand, I felt the urgency of increasing financial inclusion more than ever. Before we start this discussion, though, there are two key points to agree on:

- Having a bank account doesn’t mean someone is financially included. Instead, in the words of the World Bank, we mean having “access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance.”

- Financial inclusion is not only a problem in developing countries. I live in a developed country and still cannot access savings products that meet my needs. In fact, in the US, 14.1 million adults are unbanked,* while 1 million adults don’t have a bank account in the UK. We also see what is known as premium poverty in developed countries. Low-income households usually incur higher costs when purchasing the same essential goods and services as higher-income households – isn’t that outrageous?!

Why isn’t financial inclusion a priority for banks?

I often ponder why creating a more inclusive financial ecosystem doesn’t rank higher on banks’ strategic agenda. This is especially pertinent now, when technology and data analytics can define the right business model, leveraging technology like that from RedCompass Labs., In turn, consistently forgotten segments can be helped in a profitable manner, such as the nine million US citizens living abroad. 😉

Beyond the obvious moral duty of achieving financial inclusion, which is one of the 17 Sustainable Development Goals, it can be good for business too. As one example, EY reported that access to affordable financial products and services could increase GDP by up to 14% in large developing economies and by 30% in frontier markets.

Commitment and technological innovation: everything can help

That said, the problem of financial inclusion has started to gain momentum among banks, as the commitment to Financial Health and Inclusion, recently signed by 28 banks, demonstrated. Banks are finally committing to report progress against targets.

To be fair, this commitment, along with emerging technology like blockchain, could prove a game changer. The reduced cost of running blockchain infrastructure could help banks lower their overall costs, leading to more affordable products. Importantly, this can also ensure margins are maintained while significantly increasing the customer base.

The fact that each transaction is traceable and anonymity is programmable could also solve some of the traditional challenges of KYC in a different manner. Of course, we’re assuming that regulation progresses on this front too, allowing alternative identification methodology.

That said, the problem of financial inclusion has started to gain momentum among banks, as the commitment to Financial Health and Inclusion, recently signed by 28 banks, demonstrated. Banks are finally committing to report progress against targets.

What challenges remain?

I appreciate that adopting blockchain is not easy for banks. If migrating to ISO 20022 already represents a seismic shift for this industry, blockchain could be compared to a big bang. Indeed, using blockchain often means completely rethinking the traditional payment end-to-end architecture and significantly investing in modernisation. However, if banks want to remain competitive and participate in creating a more inclusive ecosystem, they need to jump this hurdle as soon as possible. Banks should start small, with a single use-case. It takes time to grasp the new blockchain ecosystem, understand all the underlying implications and interact with customers in this new environment.

I may not be the next Warren Buffet just yet, but the winds are changing direction… fast! Central bank digital currencies are also giving me some hope for expanding financial access, but it’s too early to comment just yet. 😉

Differences in economic standing in each community would affect both inclusion and exclusion in global financial services. Digital remittance contributes to streamlining global financial inclusion. But, when it comes to financial exclusion, in-depth understanding is important.

To understand the extent of impacts, a handy digital guide The Impact of Global Financial Inclusion & Exclusion: A Data-Driven Exploration of Access to Financial Services could perhaps help.

Share this post

Written by

RedCompass Labs