TL;DR

- MT messages won’t vanish overnight. Swift will phase them out slowly, with penalties starting in November 2025.

-

Banks must prep for structured formats. Address fields and exception messages will shift to ISO 20022 by late 2026.

-

Full migration takes time and planning. Legacy systems, data cleanup, and global standards add layers of work.

Breakups are hard. But an even more complicated split is coming later this year.

On November 22nd, 2025, Swift will stop processing MT (Message Type) messages to make way for the new standard: MX (Message Exchange) messages. From that point forward, MT and MX messages will no longer work in harmony. They will, officially, cease to coexist.

Except, well, not really. Despite being billed as the “end of coexistence,” ISO 20022 will allow MT messages to continue to live on well into 2026 and beyond.

So, what’s actually happening?

The end (of the beginning) of coexistence

Let’s start with what’s happening in 2025: big changes are coming in November, but not everything is going according to the original plan.

The ISO 20022 coexistence period started in March 2023 and was scheduled to end later this year. The plan was to gently transition cross-border payments to ISO 20022, shifting away from key payment messages like MT103—a widely used Swift wire transfer format—as the primary standard. Throughout this period, Swift has supported both MT and MX formats, including inflow translation services, to give banks time to upgrade their systems and processes (a major undertaking).

But adoption has been slower than expected. As of December 2024, less than a third (32.9%) of Swift’s payment instructions traffic had originated on ISO 20022. In June 2025 it’s risen to just under half (44.2%)

So, to accommodate those who are behind, Swift is now taking a different approach:

- Rather than immediately decommissioning MT messages, Swift will introduce penalties for messages that do not originate in ISO 20022. These will increase over time.

- Swift will offer a limited service to convert critical MT messages.

- Messages that cannot be effectively translated or processed may be rejected

- Banks must therefore be prepared to handle more rejected messages and manage exceptions.

- The translation process is for banks sending fewer than 15,000 MT messages per month. Higher volumes will require extra support from Swift at an additional cost.

In other words, legacy messages will still be around for some time – but at a cost. Swift recently published a pricing structure for penalties. Many banks may choose to pay rather than rush their migration. However, as fines increase over time, so will the pressure to fully adopt ISO 20022.

So, the “end of coexistence” isn’t really the end at all. It’s more like the end of the beginning. MT messages have moved out but still drop by on weekends for meals and laundry.

Flying the nest

So, what’s happening next? The migration to ISO 20022 structured addresses, and exception and investigation messages.

Structured addresses

Right now, addresses in payment messages are often stored in a single field, lumping together city, street, and country in one messy block. But in November 2026, this format will be retired to make way for structured data fields. The fields will provide space for specific address information (e.g., house name/number, street, city, and postcode). To accommodate differences in global address formats (because some countries, like Kenya and India, use landmarks to identify a building), the hybrid address element has space for some unstructured data as well.

Banks will have a year (November 2025 to November 2026) to migrate all address data into structured or hybrid formats. They must ensure they can process structured addresses—even if they’re not yet sending them—because they’re likely to start receiving them.

That’s going to require a lot of planning. Enterprise Resource Planning and Corporate Treasury Management Systems often use free-text or semi-structured fields for address information. Updating these vast databases will take time. And money. And patience. The work must begin now.

Exception handling

Another major shift concerns exception and investigation messages.

Today, the MT199, a free-text message, is used for everything from payment tracing to casual inquiries. It’s a catch-all. Banks send an MT199 whenever they need to ask about a payment issue, confirm details, or just check in.

For example, if a customer at The Bank of Ben claims they haven’t received a payment, The Bank of Ben sends an MT199 to The Bank of Jerry: “Hi, my client is claiming non-receipt of funds. Can you look into it for me, please?”. This triggers an investigation. The pair can use MT199 to resolve the dispute.

The problem is that MT199 messages lack structure which creates inefficiencies. This makes them ripe for replacement.

So, structured ISO 20022 messages with a specific purpose will be introduced, including:

- CAMT.110 – Payment tracing

- CAMT.111 – Rejections or returns

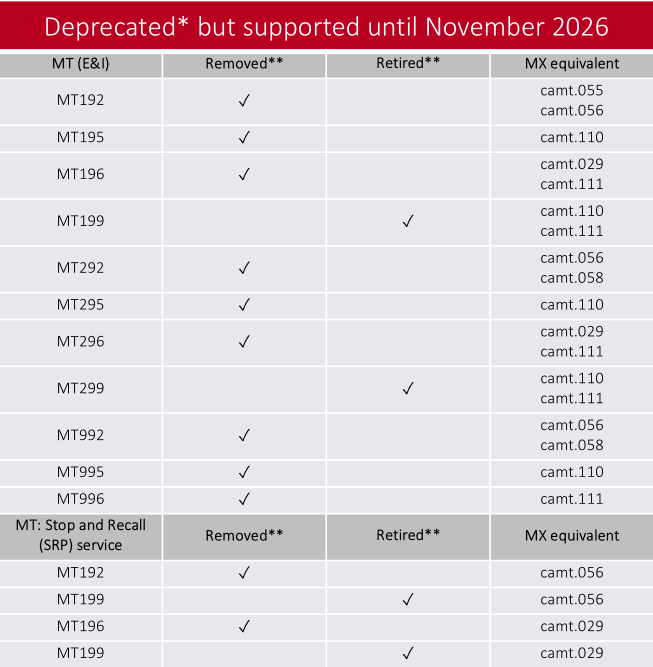

Image: CBPR+ scope of Exception and Investigation messages migration to ISO 20022 (November 2026) Source: CBPRPlus Combined Usage Guidelines.

To get ready, banks will need to update their case management systems. Alerts must be triggered only when systems can process and route new structured messages properly. This is big. It’s going to be a new way of working.

That said, not all exception-handling messages will be replaced. The move to structured CAMT.110 and CAMT.111 messages will encourage banks to shift but won’t entirely eliminate MT199 overnight.

Settling into the future

And that’s not all. More legacy messages will either be updated or phased out, including reporting, charges, and other MT messages. The MT103, the cross-border credit transfer mentioned earlier, will also be retired eventually, but there’s no set timeline for that. It will likely be a gradual process.

The Bank for International Settlements is driving global harmonization, as different regions and RTGS systems are moving at their own pace.

What’s more, domestic payment schemes are evolving separately. While CBPR+ applies globally, local systems like Fedwire in the U.S. have adopted ISO 20022 at their own pace. For example, Fedwire go-live for ISO 20022 was July 14th, 2025, but the Fed has been clear that enhancements to message usage will continue over time. This means U.S. institutions will need to adapt to both domestic and global ISO 20022 standards, adding another layer of complexity to the migration process.

So, will the ISO 20022 coexistence period really end in 2025?

Not even close. While November 2025 is the “end of ISO 20022 coexistence,” the reality is many legacy messages will still be in use for years. And there’s plenty of work still to do.

Some banks have implemented temporary workarounds instead of full migrations. Without strong financial or regulatory pressure, some may continue to delay full adoption. But at some point, the effort and risk of maintaining legacy formats will outweigh the cost of full migration.

If you’re reading this and you haven’t considered ISO 20022 beyond November 2025, now is the time. November marks a major milestone, but the full migration will take much longer. Speak to RedCompass Labs to get ready for the next phase, both technically and strategically.

Share this post

Written by

Kellie Johnson

SVP, Payments Americas, RedCompass Labs

Resources