Four systemic issues

For years, the payments modernization industry has grappled with the same four systemic issues:

The pace of change is relentless

The rate of change in payments is speeding up. That remains true every single day. Banks cannot keep up.

Payments-vendor bank chasm

There’s a gap between what banks need and what payment vendors deliver.

Smaller banks are falling behind

As the rate and cost of change increase, so does the complexity. Smaller banks cannot keep up. But they matter.

There is a shortage of payments experts

Over half (54%) of banks have delayed or scaled down a payments project in the past 12 months due to expertise gaps.

On time, on budget, and other fairy tales

This has a big impact

In a survey of 300 senior US payments professionals, we found that over four in ten (43%) believe delayed projects lead to payments outages.

The survey also revealed:

87%

of payments modernization projects go over budget

83%

of payments modernization projects overrun

83%

of payments modernization projects are not delivered to original spec

So what can you do?

With new regulations, schemes, and rails on the way, interoperable payments infrastructure around the corner, and everything from Open Banking to instant cross-border payments about to be realized:

It’s time to think about modernizing your payments systems, today.

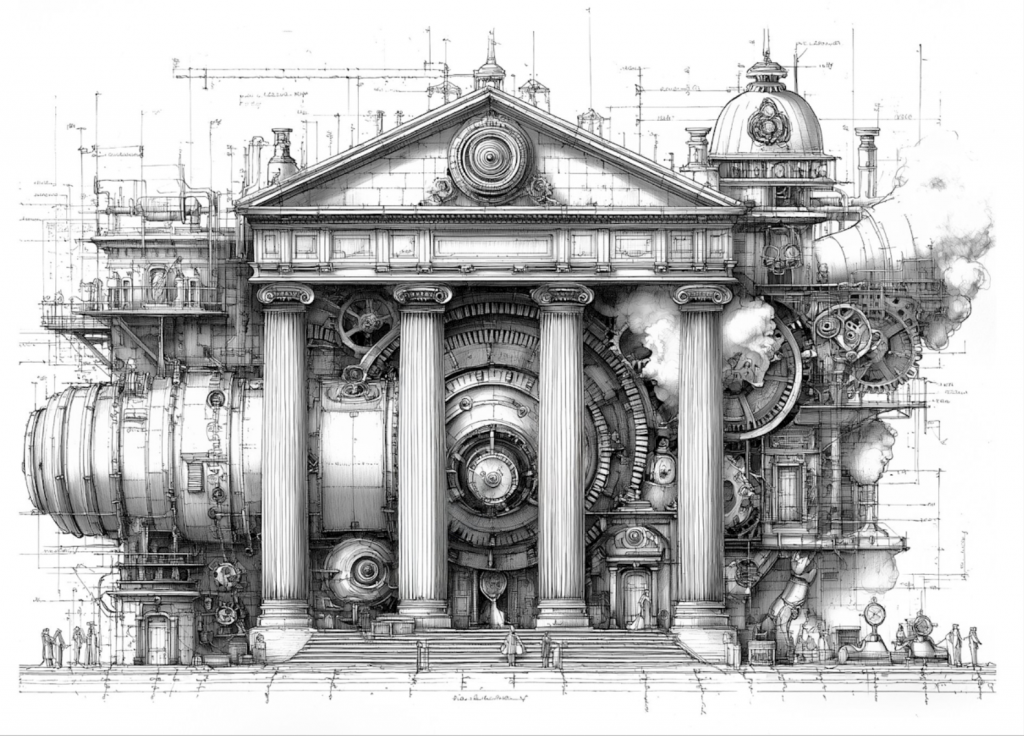

The scale of the challenge

Modernising your payments infrastructure is not easy. With so many factors involved in the process, your organisation will need to work at speed and scale to ensure a smooth, timely and efficient transition. Among the many hurdles to overcome, you’ll need to think about:

Legacy Infrastructure

Outdated payment platforms? Decades-old core banking systems? Updating these will be critical to your success. But it's time-consuming and incredibly costly if not done right.

Regulatory Compliance

As your operations become truly global, you must be ready to navigate new requirements (think: PSD3, AML, SEPA, SWIFT, RTP, and FedNow). This will involve not just investment in technology, but re-skilling your workforce, too.

Around the Clock Operations

Gone are the days of the nine-to-five. As the world migrates to Instant Payments, banking systems, customer support, fraud detection, and system stability will need to be operational 24/7/365.

Dedicated Resource Allocation

Payments modernisation projects need dedicated resources over a long period of time. It may require expertise you don't have in house.

We know payments

Why choose RedCompass Labs?

We’ve helped some of the biggest banks on the planet embrace the future of payments.

We exist to help open the doors of finance to all and to protect those who enter. We enable good payments and help stop the bad.

22+

years in payments modernization

24

countries

200+

years of combined banking experience

300+

successful projects